Commercial real estate loan amortization

Todays commercial loan rates can average between 450 and 1648 depending on the loan product. The work-life of a commercial real estate agent vs residential agents vary in work schedules and responsibilities.

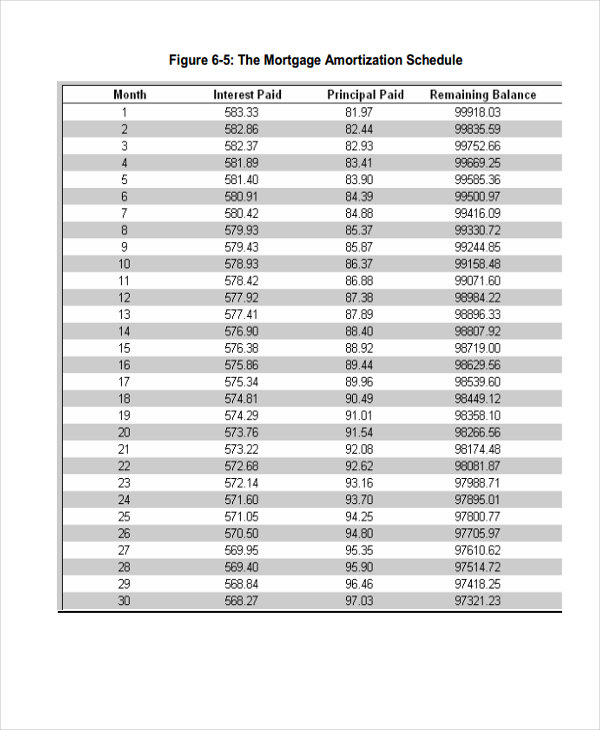

Loan Amortization Schedule Free For Excel

100 Commercial Real Estate Financing Positives Negatives Loan Options.

. The term and amortization typically match on a residential loan ie. Owner with experience in real estate and. Flexible payment terms with amortization options of up to 25 years.

For example if the property is appraised at 200000 and the lender requires a 70 LTV youll be expected to put down 60000 to receive a loan of 140000. The lender estimated the LTV on the real estate loan to be 90 percent. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Of the following types of real estate loans commercial banks are most interested in. No matter where your small business is right now we have a loan solution for you. Managing Commercial Real Estate Concentrations.

Best Small Business Insurance Commercial Auto Insurance. Loan amortization is the process of scheduling out a fixed-rate loan into equal payments. Generally commercial real estate loans come with a loan-to-value ratio LTV of around 65 to 80.

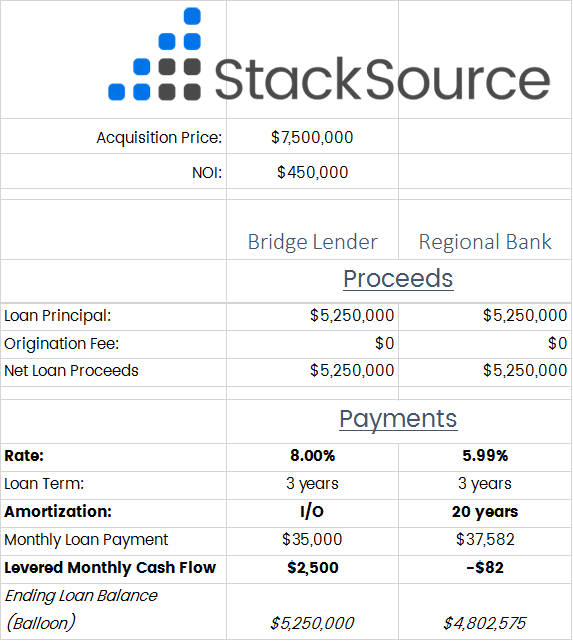

Loan sizing based on a combination of tests debt service coverage ratio loan-to-value and debt yield. The terms on the real estate loan remained unchanged. Residential agents can expect to be available to work at unconventional work times including evenings and weekends.

3030 whereas the term of a commercial loan is usually shorter than the amortization ie. 1 day agoThe borrowers net operating income has declined but reflects the capacity to generate a 108x DSC ratio for both loans based on the reduced rate of interest for the operating line of credit. This fact however is often not obvious.

Grow your business by applying for a commercial real estate loan today. Payments include principal and interest. Demand for CRE lendinga traditional core business for many community bankshas been very strong in recent years and a growing number of banks have CRE concentrations that are high by historical standards and.

This distinguishes NOI from EBITDA. Loan due term in years. Add value to your small business plus eliminate leasing uncertainties by buying renovating or refinancing owner-occupied real estate.

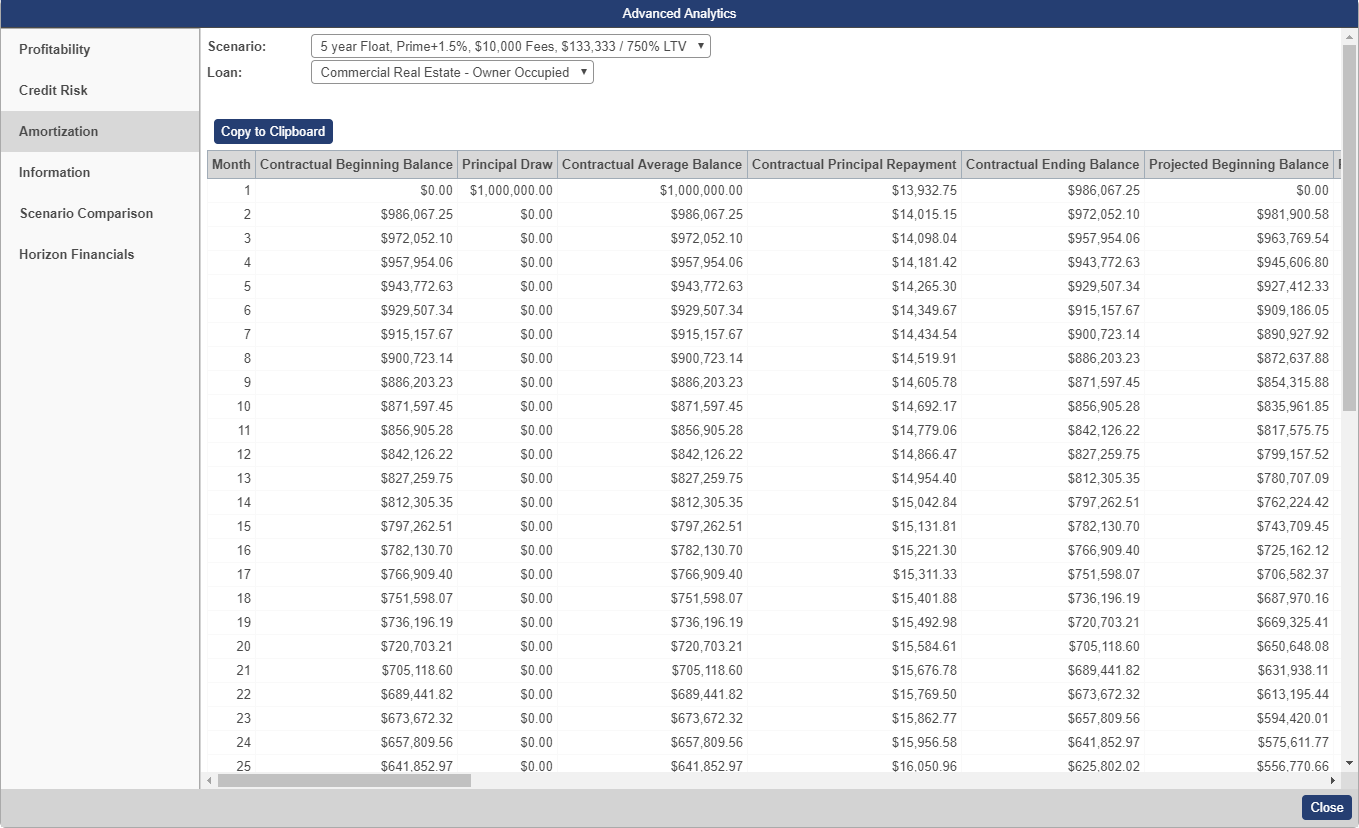

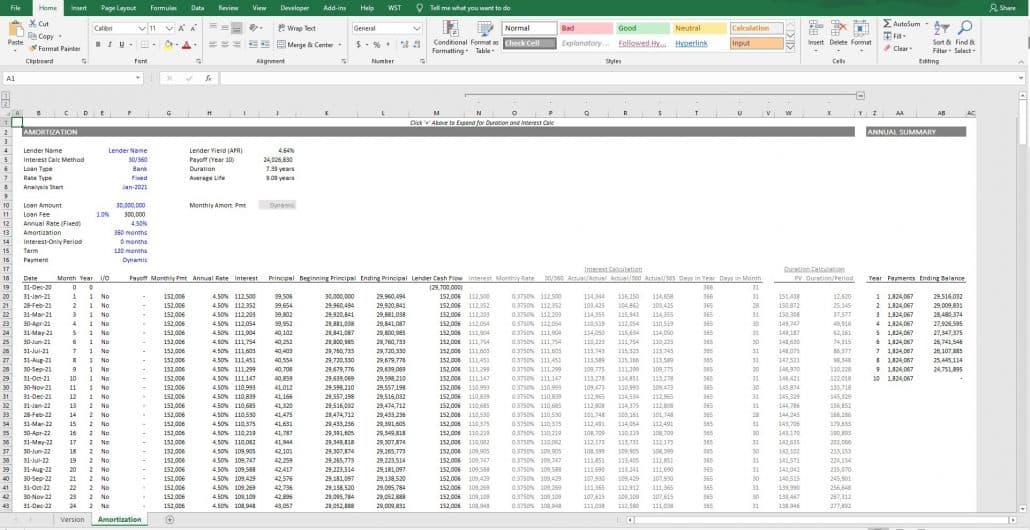

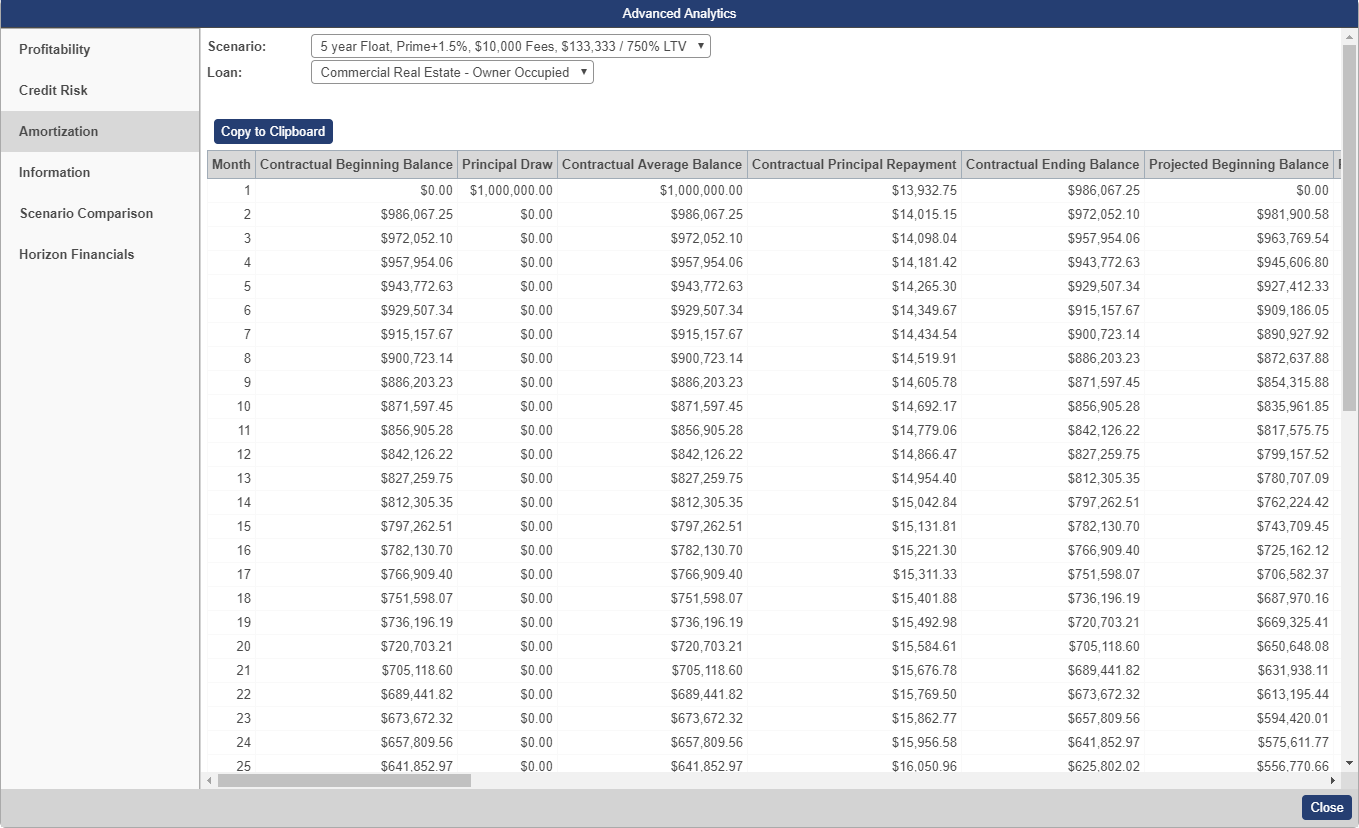

Over the years Ive received various requests to augment our library of real estate Excel models to include a model for underwriting and analyzing commercial mortgage loans. In the fields provided enter the dollar amount of the loan the annual interest rate attached to that loan the amortization term in years and the loan term in months. This tool calculates payment amounts for a given commercial property.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Business Line of. PI interest-only and balloon payments.

In commercial real estate everything from the sale to the mortgage tends to be. It provides payment amounts for three different methods. Gross rental income includes not only rent but also parking fees service fees and.

Finance Lobby is the leading commercial real estate financing marketplace. Zillow has 26617 homes for sale in Missouri. 725 causing the borrower to have to refinance or payoff the loan or sell the.

Explore all your options for commercial real estate financing and lending. Most real estate mortgages originate as. Appraisal Charges- The appraisal is an important part of the entire commercial loan process.

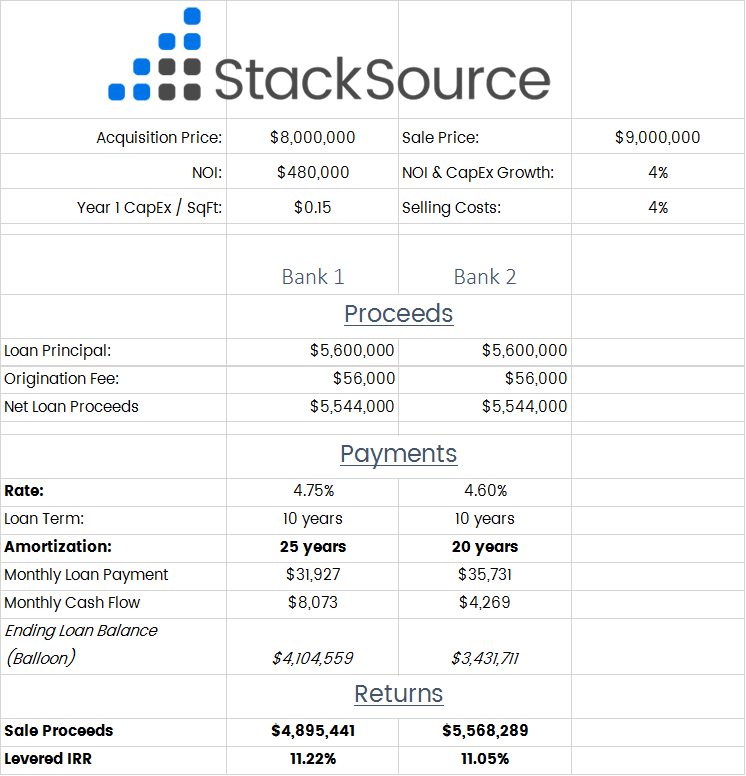

This program is typically available as a 1 year fixed a 5 year fixed or a quarterly floating rate with a 25 year amortization - all of which adjust with the Prime Rate. Our platform allows brokers to submit their deals to 1000s of lenders in minutes making better deals faster. Compared with 30 year fixed rate loans 15 year fixed rate loans tend to have higher.

Commercial Real Estate Financing Calculator. The loan amount represents the total principal on the commercial loan while the interest rate varies greatly depending on the lender type. A commercial real estate appraisal can cost several thousands of dollars because there is so much input that is needed for a proper.

We have created a glossary of the most commonly used real estate terms and their definitions in order to help you better understand terminology used along your home buying or selling process. When you first look at the licensing scheme of most states the law will say something like A broker mus. The most common business property loan offering is a 5 year fixed rate with a 25 year amortization.

To calculate a commercial real estate financing scenario an investor will need to obtain the possible loan amount interest rate amortization term and any balloon payments if applicable. Also commercial real estate loans usually involve fees that add to the overall cost of the loan including appraisal legal loan application loan origination andor survey fees. Amortization term of years.

There is a lot of real estate terminology used during the home buying and selling process and CENTURY 21 is here to help you understand those terms. Commercial real estate CRE loans comprise a major portion of many banks loan portfolios. Terms of 5 10 and 15 years and up to 25 years amortization.

Everything you need to know about the cap rate in commercial real estate including a calculator FAQs formulas examples the reverse cap rate. Commercial Real Estate Financing. P I payment.

Understanding Loan Term vs Amortization. Most states in America do not require a commercial mortgage broker to obtain a mortgage brokers license or a real estate brokers license in order to negotiate commercial mortgage loans in their state. Negative amortization describes a loan balance that.

Zillow has 16334 homes for sale in Idaho. On the other hand commercial real estate agents typically stick to the 9 to 5 workday. Specifically people have asked for a tool to calculate the loan amount ie.

EBITDA is earnings before interest taxes depreciation and amortization.

What Is An Amortization Period Bdc Ca

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

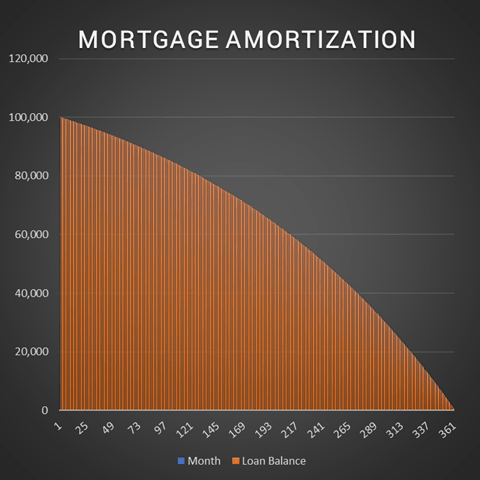

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Adding An Interest Only Period To An Amortization Schedule 1 Of 2 Youtube

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Commercial Mortgages Look At Amortization First By Tim Milazzo Stacksource Blog

Simple Interest Loan Calculator How It Works

Commercial Real Estate Loans Property Financing Lantern By Sofi

29 Amortization Schedule Templates Free Premium Templates

4 Popular Types Of Commercial Real Estate Loans In 2022

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

Real Estate Mortgage And Debt Models Adventures In Cre

Free Interest Only Loan Calculator For Excel

How To Quickly Compare Commercial Mortgage Term Sheets By Tim Milazzo Stacksource Blog

Commercial Mortgages Look At Amortization First By Tim Milazzo Stacksource Blog

The Advanced Mortgage Amortization Module Updated Jul 2022 Adventures In Cre

Understanding The Amortization Table Support Center